Once you’re in the YNAB groove, you stop looking at your bank balance and instead consult your budget when you’re deciding whether to spend money on something. Because you’re putting away money for True Expenses, your bank balance swells. But all that money is accounted for. (It’s what’s known as being YNAB Broke.) So you learn to look at your budget, not your bank account, before spending. (When you start making that behavior change you know you’re a real YNABer.)

This means you must be able to trust your budget. How can you trust your budget? By reconciling your accounts. With reconciliation you are making sure that your account balance in YNAB matches the account balance in your bank or credit card. If they don’t match, then YNAB doesn’t reflect reality. And you can’t trust your budget.

Fortunately, reconciling isn’t hard, especially if you do it frequently. I reconcile my accounts every time I’m in them, as part of my daily YNAB routine. If you don’t reconcile often, it can become more of a challenge because there are more transactions to look through to find any discrepancies.

The easiest way to reconcile happens when your bank and YNAB are playing nicely together. You click the blue Reconcile button and get a pop up that looks like this. (This example, and all that follow, are screenshots from the desktop, not mobile app.)

All you have to do is click “Looks Good!” and you’re done. (You can read my blog post called Reconcile Often to see a little video of that, which includes confetti.)

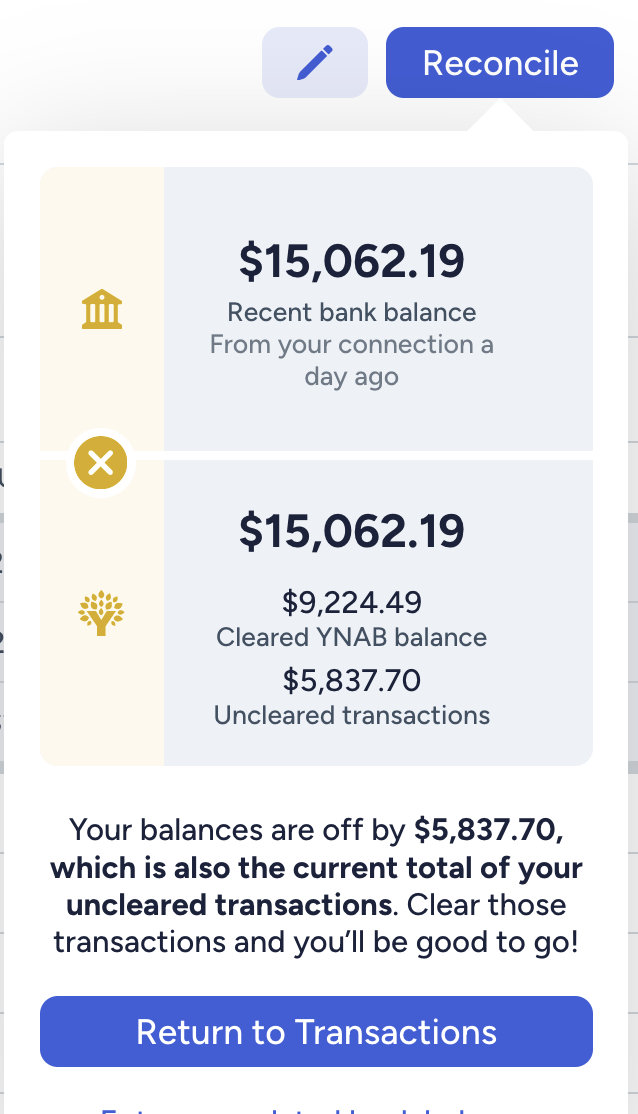

You might have uncleared transactions in YNAB that have cleared at your bank. In that case, your popup will look this:

In that case, you just click Return to Transactions and clear the uncleared transactions by clicking the little grey C in the far right column. (Alternatively, you can click on the transaction and click Clear in the floating box at the bottom of the screen.) Then click Reconcile again and the accounts should match and you can click Looks Good!

But sometimes YNAB and your account aren’t playing nicely and you get a pop-up that looks like this when you click Reconcile:

When you see this, you need to check your account balance at your financial institution. If it matches your YNAB balance, you’re golden. Just click Yes and the magic padlocks appear.

If the balances don’t match, click No. (Note: DO NOT CLICK YES IF THEY DON’T MATCH. If you do, you get padlocks that are deceiving you, which is a very sad thing.)

After you click No and enter the bank’s balance, click Next. Then you can choose to create a balance adjustment and finish or use the Reconcile Assistant, which will look for uncleared transactions that add up to the amount you’re off.

A balance adjustment will add or subtract the amount of the discrepancy in your account and either add or subtract that amount from your Ready to Assign. Personally, I don’t like to do a balance adjustment unless the amount is under $10. Otherwise, I keep looking for the discrepancy.

If all this sounds like a pain in the butt, it can be. But it’s worth the effort. And again, the more frequently you correctly reconcile, the easier it is to find the discrepancy if there is one.

Next week, I’ll provide some tips for finding discrepancies when you’re having a hard time reconciling. It’s not necessarily hard when you know where to look!

Leave a Reply