The YNAB Blog

-

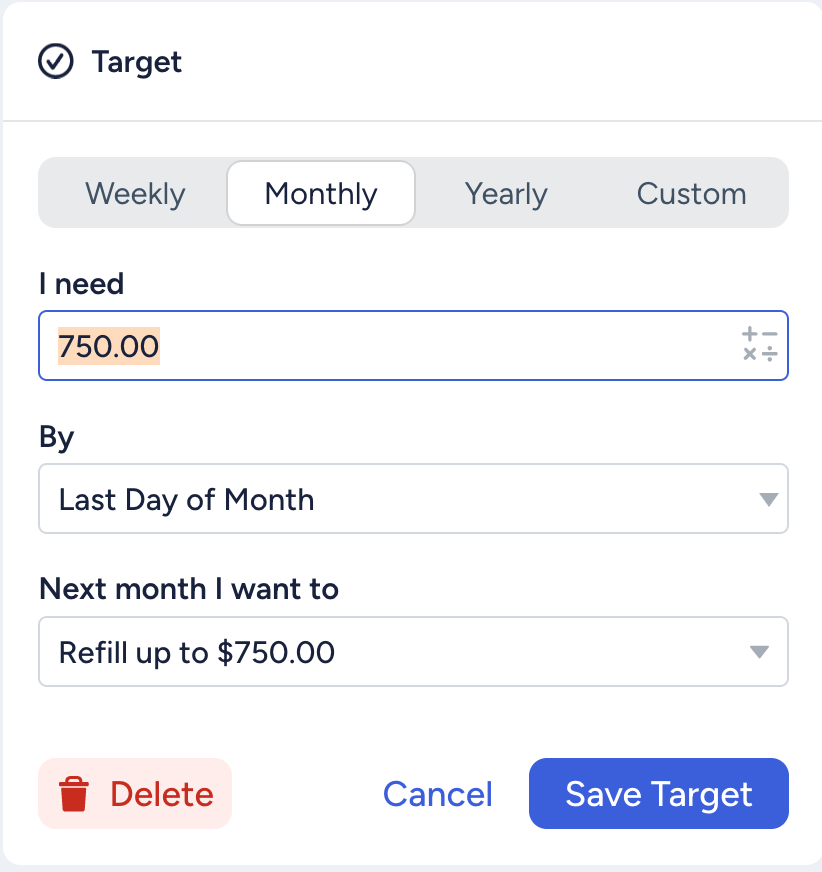

Simplified targets are coming!

When YNAB added targets (back then they were called goals), it was such a great feature addition. But the target types were challenging to understand. In fact, it wasn’t until I took my training to become YNAB Certified Budgeting Coach that I actually understood the target types and could explain them. Even then, the ones…

-

Are you still paying for your kids’ cell phones?

So many of my budget clients have large cell phone bills. When we take a look at the bill, we see that their children’s cell phones are bundled into their bill. More often than not, the practice started when their kids were still dependents. Yet the parents keep on paying. I always push back on…

-

Things to do at the end and beginning of a month

Note: This is a lightly edited version of a post I created last year that offers a good reminder of the importance of paying attention to YNAB at the turn of the month. The turn of the month is a special time in YNAB. When the calendar month rolls over, things happen. Luckily, they’re predictable,…

-

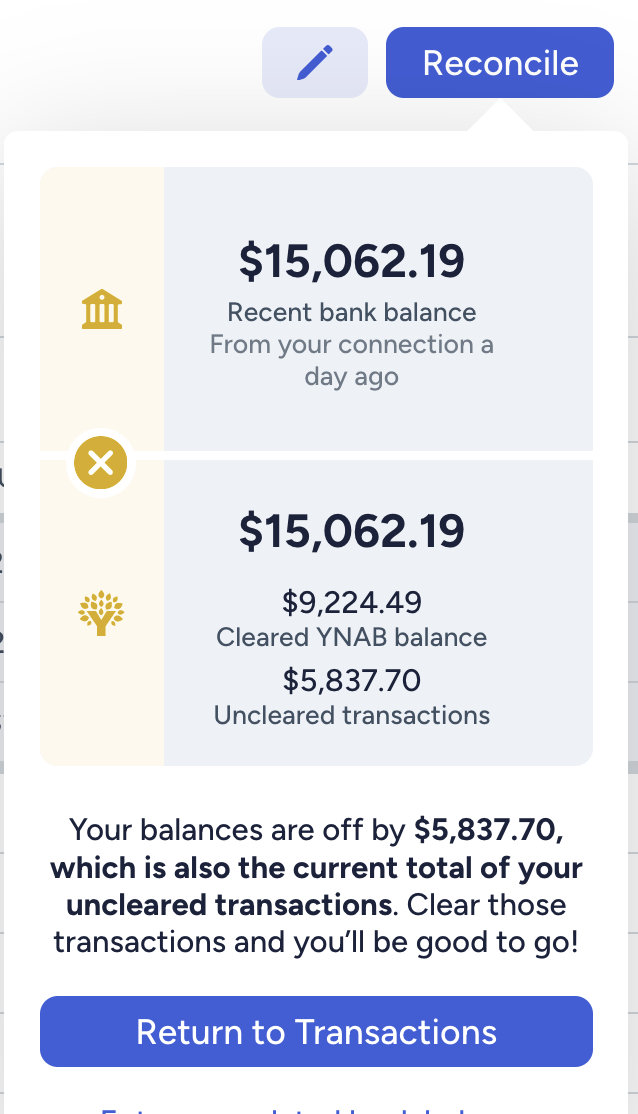

Tips for finding discrepancies

If you’ve tried to reconcile your accounts in YNAB and given up because you couldn’t find the problem, you might had had YNAB do a reconciliation balance adjustment. That’s fine. But if the discrepancy is large (say, $100 or more) I think it’s worth looking a little harder before doing an automatic adjustment. Last week…

-

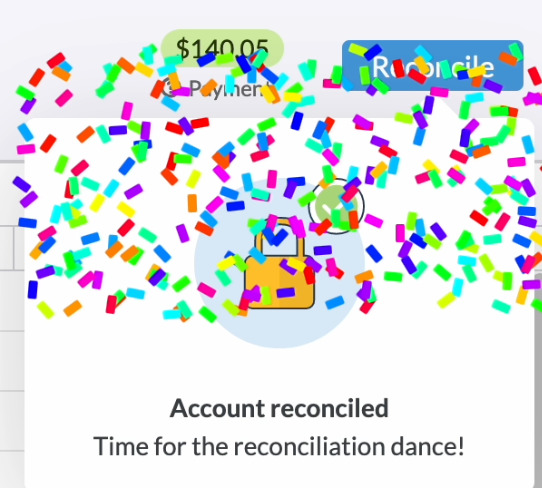

Why it’s important to reconcile (and how to do it)

Once you’re in the YNAB groove, you stop looking at your bank balance and instead consult your budget when you’re deciding whether to spend money on something. Because you’re putting away money for True Expenses, your bank balance swells. But all that money is accounted for. (It’s what’s known as being YNAB Broke.) So you…

-

Do your taxes sooner rather than later

In the United States, most federal and state income taxes are due on April 15. A lot of people put off doing their taxes. According to the 2024 Tax Procrastinators report, 29 percent of Americans procrastinate on their taxes. (I would have guessed that figure was higher!) I’ll never forget the time I had to…

-

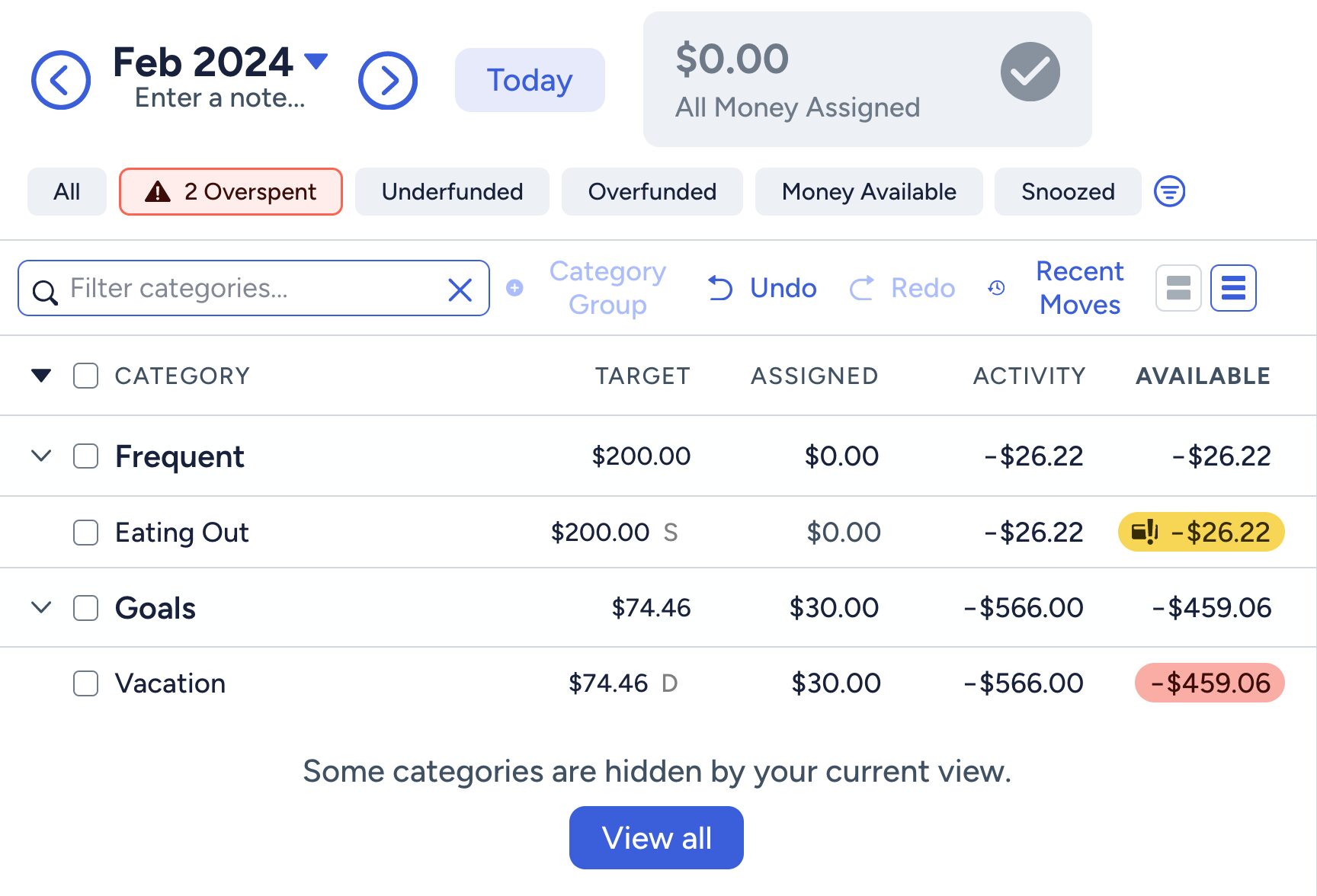

Quick Tip: Check your February transactions!

Today is March 1, which is a fun day for me because I get to do some budgeting! I was reminded today of the importance of making sure I process all my February transactions before assigning money in March. This morning, I categorized all my pending transactions and clicked Enter Now so that they would…

-

Revealing the running balance

When I work with clients, they typically share their screens with me. We’re often working on reconciling their accounts and I’ve learned that many of my clients aren’t aware of the Show Running Balances setting that’s hidden under the View dropdown next to the search box in any account screen. Here’s a photo of what…

-

Keeping my freezer inventory in YNAB

My husband and I have three freezer spaces in our house. The main one in our kitchen is a bottom drawer freezer. (The other two are top freezers in extra refrigerators.) The drawer freezer was a hot (well, cold) mess. I find it’s really easy to lose stuff in it. My husband, Barry, who is…

Are there YNAB and budgeting topics you’d like me to write about?